Everyone gets a tax credit — and now it includes recent HVAC improvements.

On December 19, 2014, the Tax Increase Prevention Act of 2014, was signed into law, retroactively allowing eligible HVAC AND Water Heating products installed between January 1, 2014 through December 31, 2014, to be eligible for Federal Tax Credits.

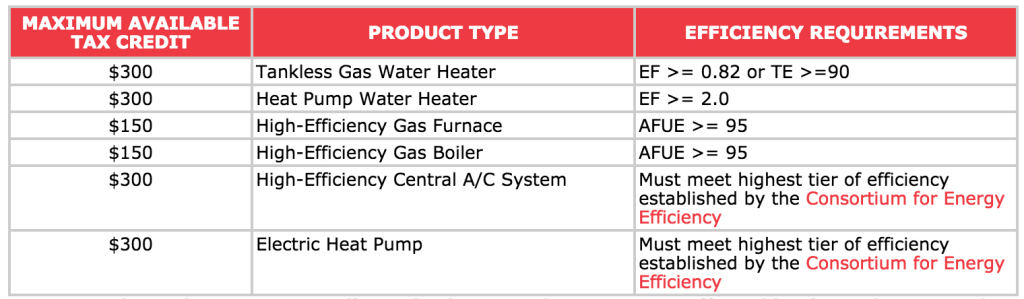

The maximum amount an eligible homeowner may receive in tax credits for improvements is $500. If a homeowner has already claimed credits of $500 or more from improvements made in 2011 – 2013, they are ineligible to claim new credits for any new improvements made during 2014. See the chart below for more details on qualifying products. Tax Credits are available for 10% of installation costs up to the maximum amounts shown in the chart below.

NOTE: Geothermal system and solar water heater tax credits are unaffected and remain in place through 12/31/2016.

IMPORTANT: This information is provided to assist in identifying applicable tax credits for Rheem products, and should not be considered tax advice. Consult your tax professional to review your particular circumstances.

To claim their Federal Tax Credit, a homeowner will need to file Form 5695 (Residential Energy Credits) and should keep applicable invoices and the Manufacturer Certification Statement for their records. More information on tax credits as well as helpful links are available on Rheem.com and MyRheem.com. Tax Credit Forms/Certification Statements for qualifying models will be updated and available on Rheem.com by February 27, 2015. – Rheem Air Conditioning Division